AI-Derived Consumer Insights: Weaknesses in Herbal Essences' Product Lineup

LLM-driven analysis of 6,000 consumer reviews surfaced two shortcomings in Herbal Essences’s portfolio: specific unmet needs and a group of redundant product offerings.

Consumer insights teams at beauty brands already have access to huge amounts of unstructured feedback. Commonly, this feedback is run through sentiment analysis in order to gauge how favourably consumers regard specific products. We present a much higher specificity approach to analysis, using LLMs to extract data from each review along prescribed dimensions.

From 6000 reviews of Herbal Essences products (1), we derived the following concrete and actionable business intelligence.

Key findings

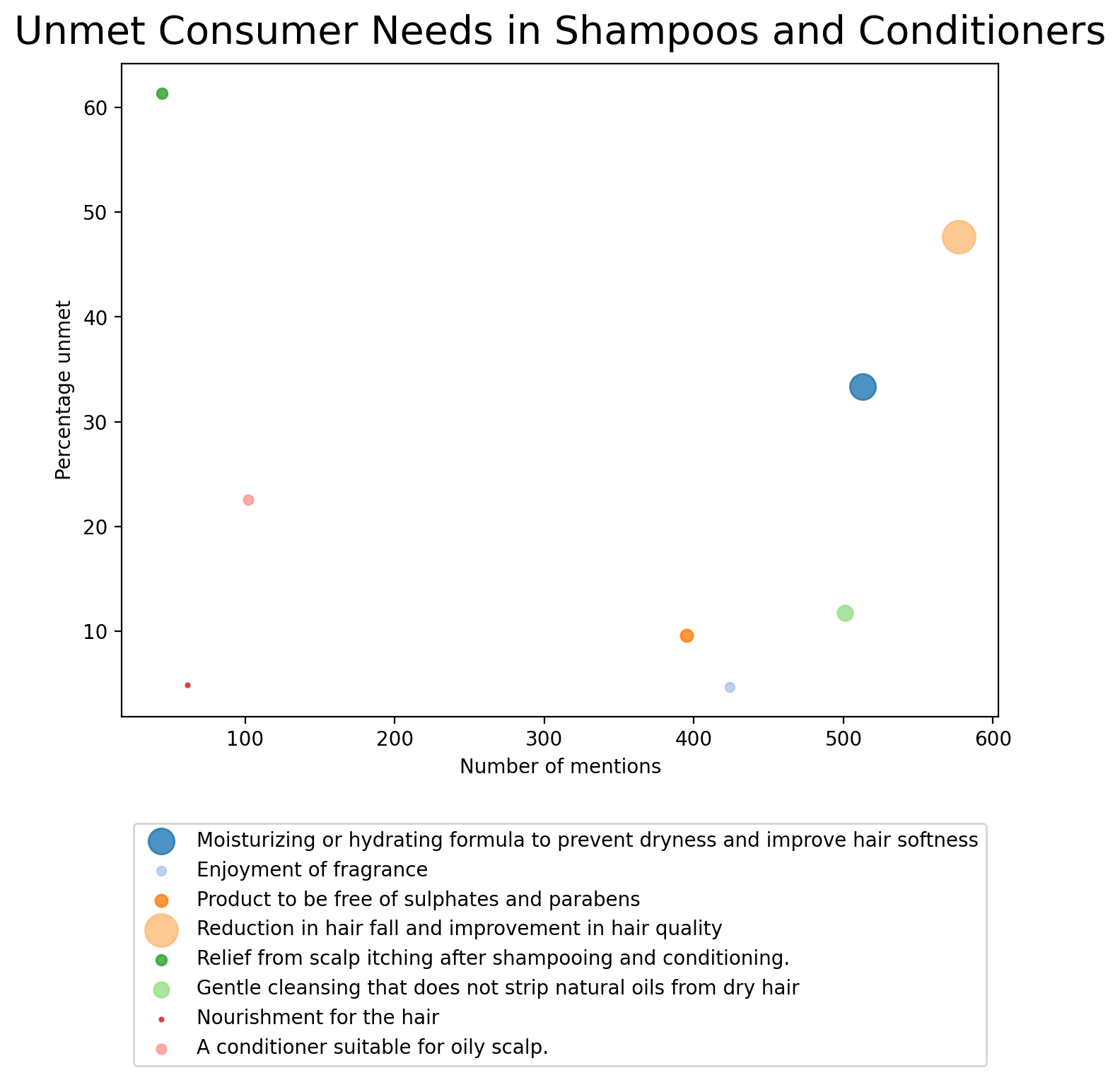

Major unmet consumer needs identified in the shampoo/conditioner category: hair fall reduction, scalp itch relief, improved softness/moisture

While only around 1% of identified customer needs relate to relief from scalp itch, it is acutely failing to be met by any product.

Reduction in hair fall and improved hair softness are comparatively more common (8-10%), although slightly less significantly failing to be met.

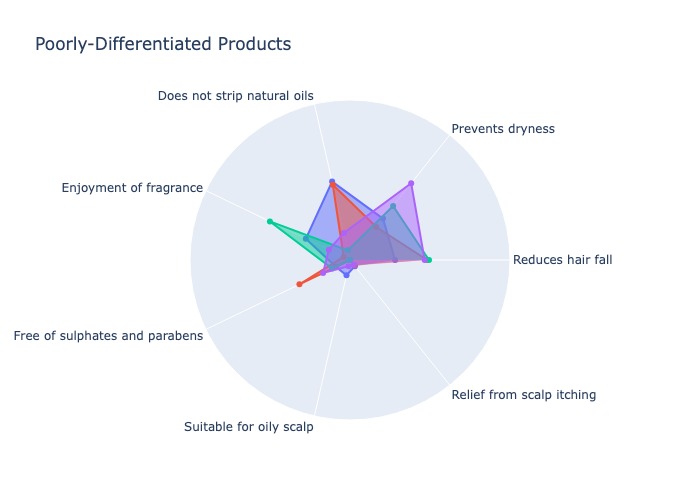

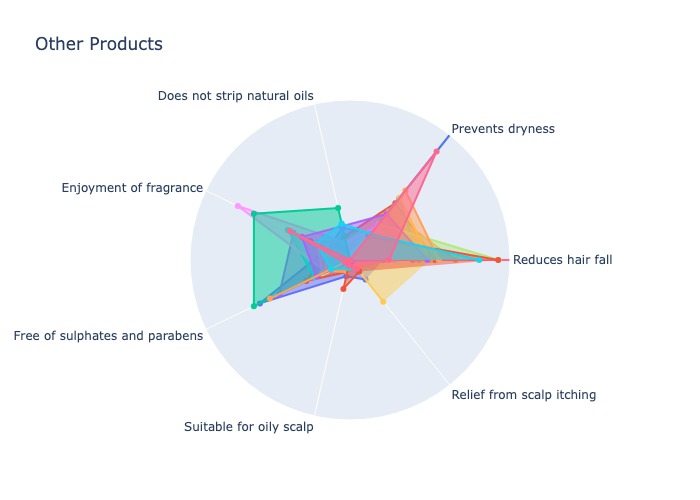

Current product lines are poorly differentiated, creating risk of customer attrition

(Scores in each dimension are the fraction of each type of need that were met by a given product, where the entire radius of the circle is a maximum of 80%.)

The following products are almost indistinguishable across the major identified needs:

- - “Herbal Essences Strawberry & Mint Shampoo - For Cleansing & Volume - Paraben Free”,

- - “Herbal Essences Aloe & Bamboo Shampoo For Soft Smooth Hair, No-Sulphates, Paraben and Silicones”,

- - “Herbal Essences Bio:Renew Strength Whipped Cocoa Butter Conditioner”,

- - “Herbal Essences Coconut Milk Shampoo For Hydration & Softness - No Parabens- No Colourants”

Approach

Using large language models, we extracted from each review a list of ‘needs’ described by customers. We further asked the LLM to determine whether or not that each need was met as a result of using the product.

To define clear categories of needs, we use natural language processing to cluster the individual mentions of needs into emergent categories.

The result is a structured dataset that we analyze across the following dimensions:

- - product name

- - type of need

- - whether or not a need was met

Strategic recommendations

- 1. Surgically address top pain points by reformulating targeted lines or launching purpose-built SKUs for hair fall and scalp comfort.

- 2. Re-segment and clarify product portfolio: either reposition, differentiate, or sunset undifferentiated products.

Potential Commercial Impact

Major unmet consumer needs point to up to $90M in un-captured market share

We estimate Herbal Essence's 2025 revenue at \$3.52B based on having 22% market share (2) in a \$16B North American hair product market (3).

The significant unmet consumer needs we identified constitute 2.6% of all instances of customers mentioning needs in product reviews. If every identified unmet need mapped directly to a lost sale, this 'need-gap' would be worth 2.6% of Herbal Essence's yearly revenue at \$90M.

In practice, some amount of customers are likely already buying in spite of their unmet need, and thus $90M is an upper bound on the actual potential market share.

Redundant product offerings could be losing $35M annually to other brands

Product differentiation has been shown to strongly correlate with customer loyalty (4). Assuming a modest current repeat purchase rate of 20% (5), improving that retention rate to 21% stands to add $35M to Herbal Essence's yearly revenue.

Next steps

We hope that this article has demonstrated a clear application of LLMs to surface structured, high-signal insights from textual datasets. This is a repeatable framework for analyzing needs and their relative importance to a consumer base, from a dataset that would traditionally have offered nowhere near such clear insights.

With reliable revenue data across product lines, we could take the analysis further and assign a specific dollar value to needs in the marketplace, to truly identify which needs customers are willing to pay for, and which they are willing to live with unmet. In the absence of such data, our revenue impact estimate are frankly speculative, but included for an estimate of scale.

See the detailed technical analysis

References

- 1. https://www.kaggle.com/datasets/jithinanievarghese/cosmetics-and-beauty-products-reviews-top-brands

- 2. https://www.statista.com/forecasts/1340174/herbal-essences-hair-care-brand-profile-in-the-united-states

- 3. https://www.statista.com/outlook/cmo/beauty-personal-care/personal-care/hair-care/north-america

- 4. https://www.bircu-journal.com/index.php/birci/article/download/6385/pdf

- 5. https://gcimagazine.texterity.com/gcimagazine/may_2024/MobilePagedArticle.action?articleId=1972798#articleId1972798